Guaranteed Asset Protection (GAP)

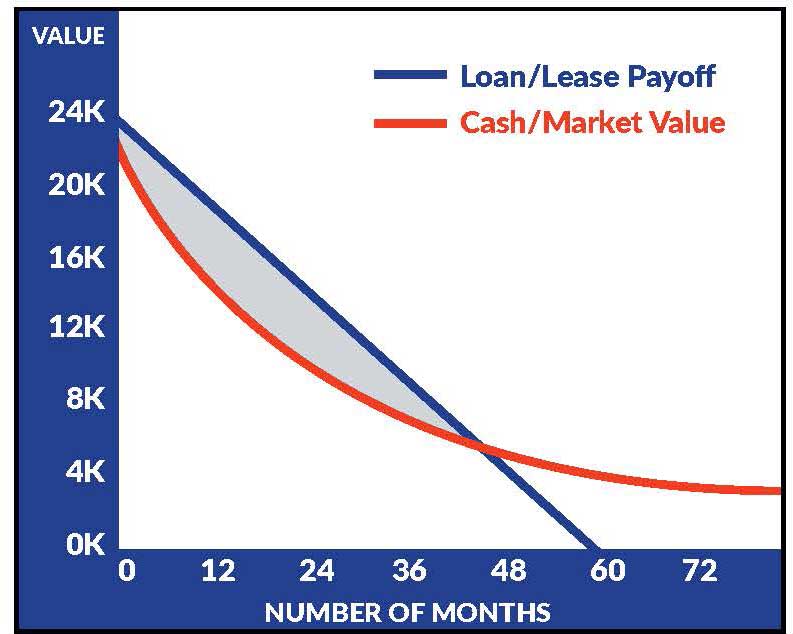

Gap is the difference between the actual cash value of your vehicle and the amount of the loan at the time it was stolen or totaled in an accident.

Why do you need this protection?

First few years of ownership, there is a high probability the actual cash value of the vehicle being worth less than the loan payoff.

If your car is deemed a total loss, the “GAP” could translate to thousands of dollars still owed after your insurance company paid the actual cash value of the vehicle.

Why is Dealer Gap is better than insurance company gap?

- Insurance companies most times only covers 125% (not retail or msrp). We are 150%.

- Insurance company GAP doesn't always cover deductible. We cover up to $1000 in deductible.

- If you have a total loss and GAP through your insurance company, it could count as two separate claims against your insurance record, which means you will have higher rates. With us, the total loss is one claim and the gap payment is 2nd claim.

- If a vehicle is close to being totaled but the insurance company is also on the hook for GAP, there is a chance they will try not to total the car (if possible) to avoid paying the gap settlement as well. Therefore, you'll be left to drive a vehicle that "maybe" should have been a total loss.

Warranties include 10-year/100,000-mile powertrain and 5-year/60,000-mile basic. All warranties and roadside assistance are limited. See retailer for warranty details.

Warranties include 10-year/100,000-mile powertrain and 5-year/60,000-mile basic. All warranties and roadside assistance are limited. See retailer for warranty details.